tax air freight rules tariff

What Is an Air Cargo Tariff. 302012-ST and hence not liable to pay service tax under reverse charge basisThanks.

Iata Air Cargo Tariffs And Rules What You Need To Know

Of Air Express 12 JOURNAL OF AIR LAW AND COMMERCE 229-31 1941.

. An excess value declared value fee will be assessed and billed for the excess of the allowable free value at a rate of 065 per 10000 per part thereof subject to a 200 minimum charge. We are paying to our foreign supplier in advance through proforma invoice which was excluding freight. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam or certain telecommunications services 1 sold or rented in Massachusetts.

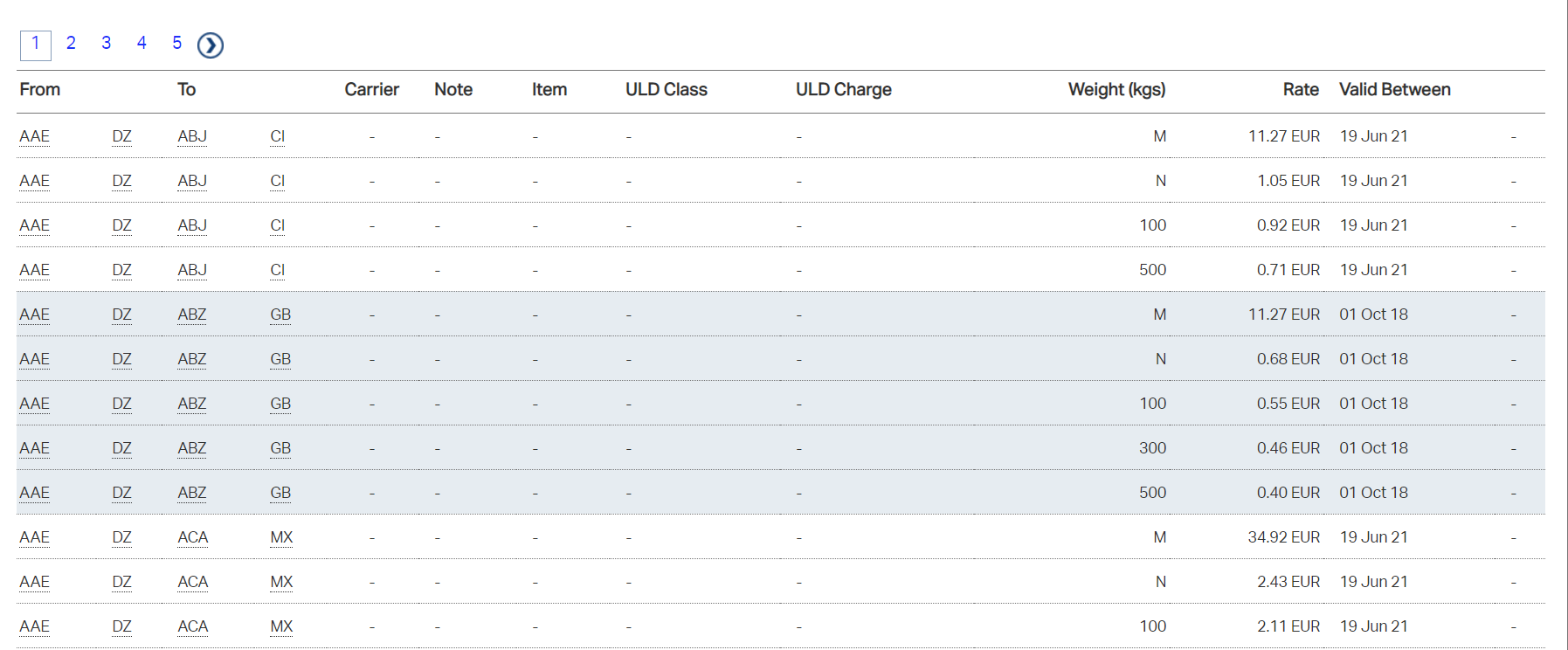

With seven terminals conveniently located throughout Wisconsin Minnesota Iowa and Illinois and a wide network of carrier partners Tax-Air is perfectly positioned to quickly and affordably help with all your transportation needs. A tariff is a concept that encompasses sectoral air cargo rates published by each carrier and related rules. Once this threshold is reached all additional imports face a higher sometimes prohibitive tariff rate.

A fee of 8500 will be charged per shipment. Air freight and air cargo are generally the same. B In the event of any conflict between the provisions of this tariff and the provisions of any air.

A fee of 40000 will be charged per shipment. The Air Cargo Tariff and Rules TACT The ultimate reference for air cargo transportation. TDS on Air Freight included in suppliers bill in case of imports.

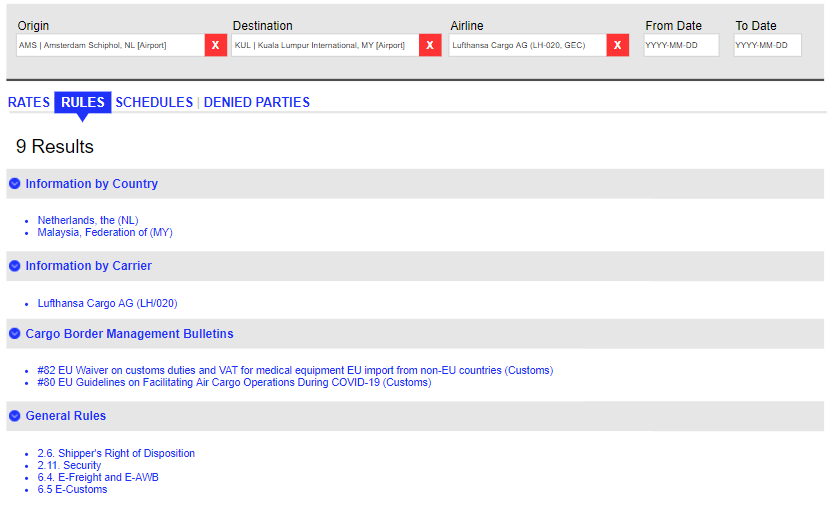

Search in real-time for rates rules compliance regulations and as air cargo schedules. All references in this tariff to Bill of Lading terms published by the National Motor Freight Classification or otherwise refer to the version of the Uniform Straight Bill of Lading as it existed in NMFC 100 Item 365 on August 1 2016 without the modifications made by Supplement 2 to NMF 100-AP issued July 14 2016 by the NMFTA with an. Application and Precedence of Rules and Tariffs190 5 Bills of Lading Freight Bills and Statement of Charges 360 8 3900 per request per shipment.

National sales and local taxes and in some instances customs fees are often charged in addition to the tariff. Tax-Air knows the importance of picking up and delivering LTL FREIGHT on time damage free. Air cargo tariffs are determined by each air carrier or at the industry level.

UPS Next Day Air Early UPS Next Day Air UPS Next Day Air Saver UPS 2nd Day Air AM UPS 2nd Day Air UPS Hundredweight Air Services includes. You can now access air cargo rules regulations rates and charges to stay up-to-date and flexible in a world of ever-changing air cargo data. October 10 2012 Page 18 of 40.

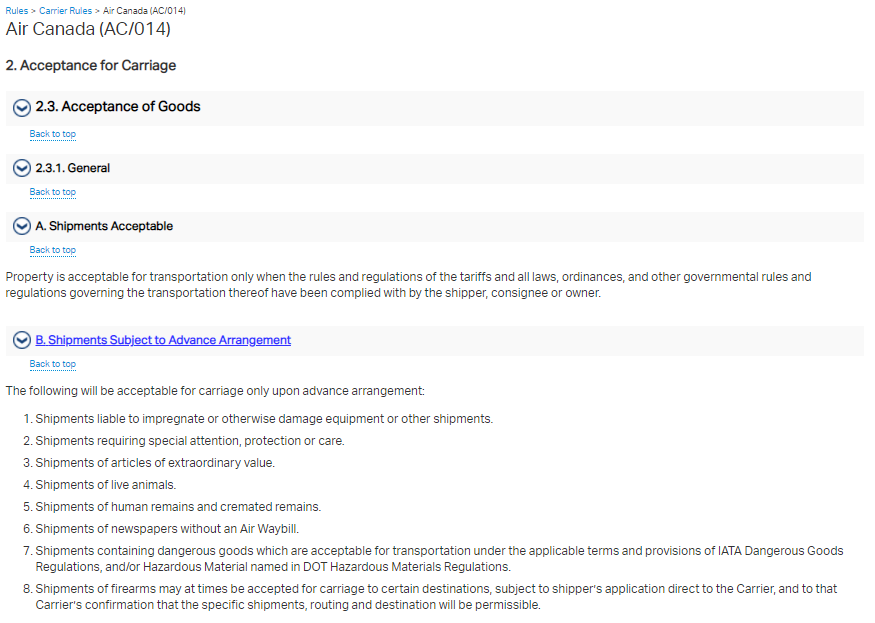

Headquartered in Milwaukee WI Tax-Air is a leading provider of logistics and transportation services and has been a trusted partner in the freight forwarding industry for 40 years. A fee of 18500 will be charged per shipment. APPLICATION OF TARIFF a Air carriage will be subject to the rules rates and charges in effect on the date of signing the air waybill.

A fee of 53000 will be charged per shipment. RULES TARIFF FCSY 100-A Effective January 1 2012 Page 6 of 30 Frontline Freight is entitled to receive compensation for providing special services requested or required by shipper or consignee and will bill its published charges for such services whether or not shipper or consignee has authorized such charges in writing. The Air Cargo Tariff and Rules TACT An essential extension of TACT in Manual On-line and web service.

Rules circular 100 original title page eagle air freight inc. But when referring to the goods being shipped. Pilot Freight Services Rules Tariff No.

A fee of 13500 will be charged per shipment. UPS Ground with Freight Pricing UPS Hundredweight Service Ground UPS Returns Services UPS Air Services includes. When you talk about air freight and air cargo the term can mean a difference in the merchandise being shipped versus money charged for the shipment.

Eastern filed several tariffs effective in 1945 covering transport of magazines and news-. UPS Hundredweight Service. The buyer pays the sales tax as an addition to the purchase price to the vendor at the time of purchase.

AF 2 both effective Oct. Below a specific value or quantity of imports a lower tariff rate applies. PO Box 070911 Milwaukee WI 53207.

Now they raised commercial invoice where freight charges in included and Bill of entry also bears the same value as on commercial invoice. Mc 99655 usdot 268906 freight rules circular naming rules regulations accessorial services and charges applying on freight all kinds prior or subsequent to transportation by domestic air carrier from or to points and places within the continental united states. The Air Cargo Tariff and Rules TACT provides air cargo professionals with the comprehensive information they require to efficiently transport air cargo worldwide.

Headquartered in Milwaukee WI Tax-Air is a leading provider of logistics and transportation services and has been a trusted partner in the freight forwarding industry for 40 years. PO Box 070911 Milwaukee WI 53207. The rate is the amount charged by the carrier for the carriage of a unit of weight and may differ from actual selling rates.

Different tariffs applied on different products by different countries. Charges for this service will be assessed a rate of 1000 per 100 pounds subject to a minimum charge of 9500 and a maximum charge of 60000. 13-1-2017 By- KASTURI SETHI.

If a customer has a negotiated rate less than 330 per cwt subject to a minimum charge of 7840 per shipment Carriers maximum liability will be 070 per pound. With TACT Online you can search and consult the entire content of TACT Rules Rates and Schedules. Leverage our operational dashboards to keep track of market activity without having to contact individual airlines handling agents or airport operators.

For this service Carrier shall charge. Air freight service is not enumberated in the reverse charge notification no. Broker Diversion at USMexico Border 821-3 63 Brokerage-Inclusive 485 15 Bulk Mail 365 9 Calculation of Cube 192 6.

Blind Shipments 822 38 16600 per shipment. The industry reference for air cargo professionals. Tariff-Rate Quota TRQ TRQs involve a two-tiered tariff scheme in which the tariff rate changes depending on the level of imports.

AF 1 and Air Freight Tariff No. Services provided under this item do not include charges for service to floors above or below the level accessible to Carriers vehicle or any other applicable charges. 330 per cwt subject to a minimum charge of 7840 per shipment.

A tariff or duty the words are used interchangeably is a tax levied by governments on the value including freight and insurance of imported products. The rate is the amount inserted into the Air Waybill AWB and is the basis for discount. 3 Americans tariffs were Air Freight Classification No.

Us Import Duty Custom Duty Calculator Freightos

Fonoa Uk Sellers Exporting Goods To The Eu What You Need To Know

Freight Between Uk And Us Rates Transit Times Duties Taxes Advices Docshipper Uk En

Iata Air Cargo Tariffs And Rules What You Need To Know

Taxes Vat Duties And Tariffs For Imports Chambercustoms Customs Clearance Agents Customs Training Cutoms Consultants

The Difference Between Duties Taxes And Tariffs How They Factor Into Your International Shipping Strategy Dcl Logistics

How Uk Eu Trade Deal Will Change Relations Between Britain And Brussels Financial Times

Air Cargo Terms And Abbreviations United Worldwide Logistics

How To Export From Vietnam To The Eu Cosmo Sourcing

Do I Have To Pay An Import Tax From China To The Uk

Iata Tact Manual Air Cargo Tariff And Rules And Regulations

Freight Between Vietnam And China Rates Transit Times Duties Taxes

Iata Air Cargo Tariffs And Rules What You Need To Know

Iata Tact Manual Air Cargo Tariff And Rules And Regulations

Service Area Transit Time Tax Air

Iata Air Cargo Tariffs And Rules What You Need To Know

Taxes Vat Duties And Tariffs For Imports Chambercustoms Customs Clearance Agents Customs Training Cutoms Consultants